RWA Compliance Services Ltd is a leading provider of regulatory compliance consultancy and training services within the UK general insurance broking sector. RWA provides the Aviva Development Zone, a market-leading learning management system that helps general insurance intermediaries meet their learning and development needs, including regulatory Continuous Professional Development requirements.

The Challenge

RWA’s original Development Zone Learning Management System was developed over eight years using Moodle v.2.4.3 together with numerous custom plugins.

The system contained over 500 SCORM courses and was used extensively by over 16,000 users across nearly 800 client firms, with a focus on meeting annual CPD requirements set by the Financial Conduct Authority and the Chartered Insurance Institute.

However, by 2020, it became apparent that the system’s outdated software required a significant update or rebuild to ensure Development Zone’s sustainability and growth while retaining or improving the platform’s unique functionality.

Migrating all learners, firms, enrollments, courses, and learning history to the new system with minimal disruption and ensuring end-user acceptance was essential as the Development Zone is a critical part of RWA’s business model.

The Solution

In 2021, RWA partnered with Catalyst IT EU to utilize Totara 14 to create an entirely new version of the Development Zone.

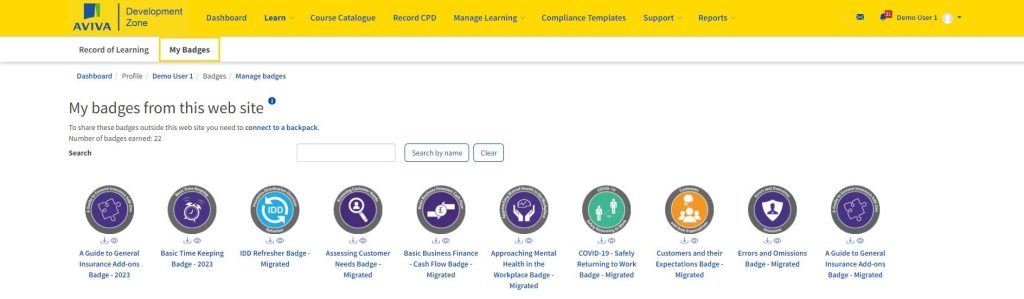

Totara was selected because it included core functionality, particularly multi-tenancy and audiences, which would help meet the needs of RWA’s client firms, as well as retaining key features utilized within the original Development Zone, such as open-badges.

Furthermore, the flexibility and customization offered by Totara meant that RWA could work with Totara partner Catalyst to create bespoke plugins that would directly add value to RWA’s users. Identified development needs included a CPD Recorder aligned to regulatory reporting requirements, as well as a new learning allocation management control panel to allow supervisors/managers within tenancies to assign, manage and monitor learning across their organization.

In addition, tools would be required to enable data transfer from the original platform to the new Totara site.

Results

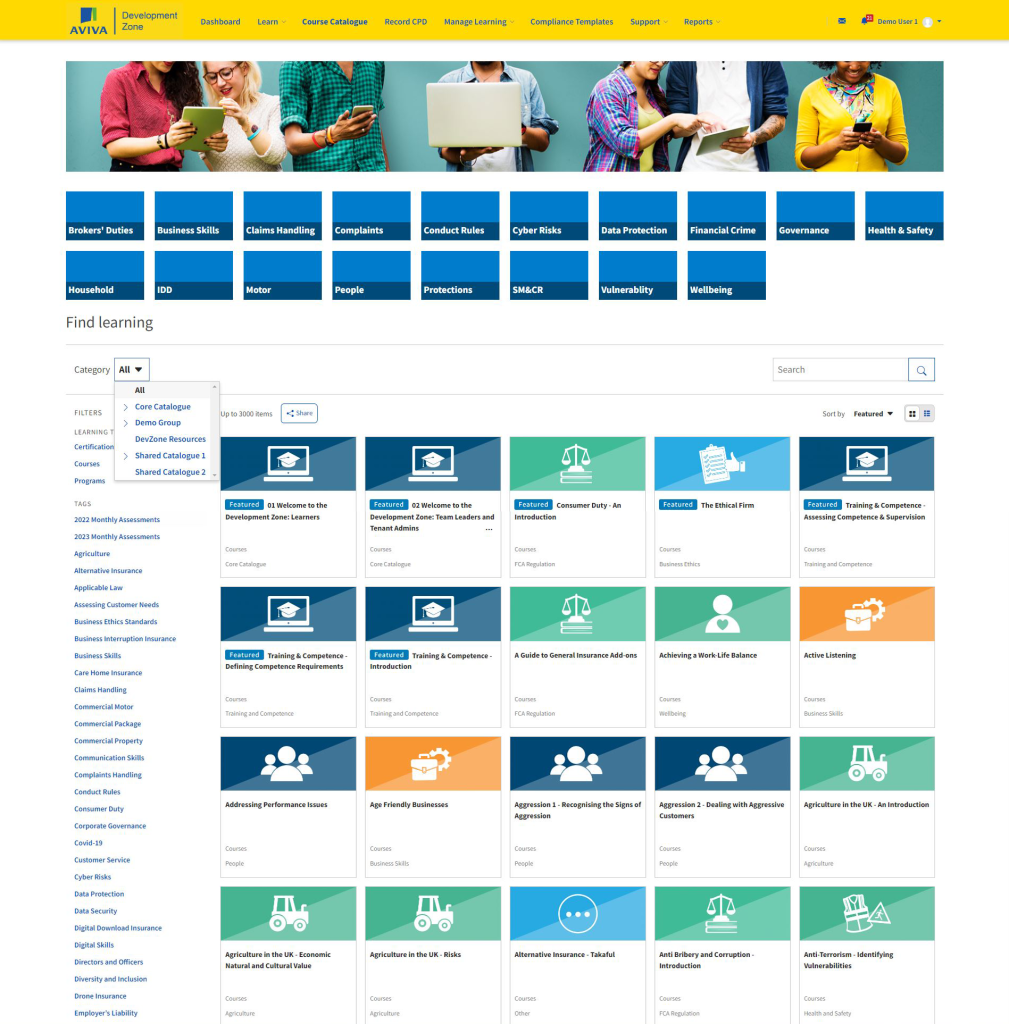

A new instance of the Aviva Development Zone was set up using Totara 14, incorporating over 800 tenancies. This allowed each client firm its own tenant catalogue where it could include its internal training material, in addition to RWA’s core content catalogue of 500 courses.

Utilizing data transfer tools developed by Catalyst, RWA’s entire e-learning client base was migrated from the old system to the new, in phases, from July 2022 to March 2023, supported by RWA’s client engagement team. Currently, some 16,170 users and 880 tenancies are on the system.

In addition to the core Totara system, RWA and Catalyst collaborated on the creation of bespoke plugins to meet the demands and needs of RWA’s clients within the general insurance industry, notable examples are:

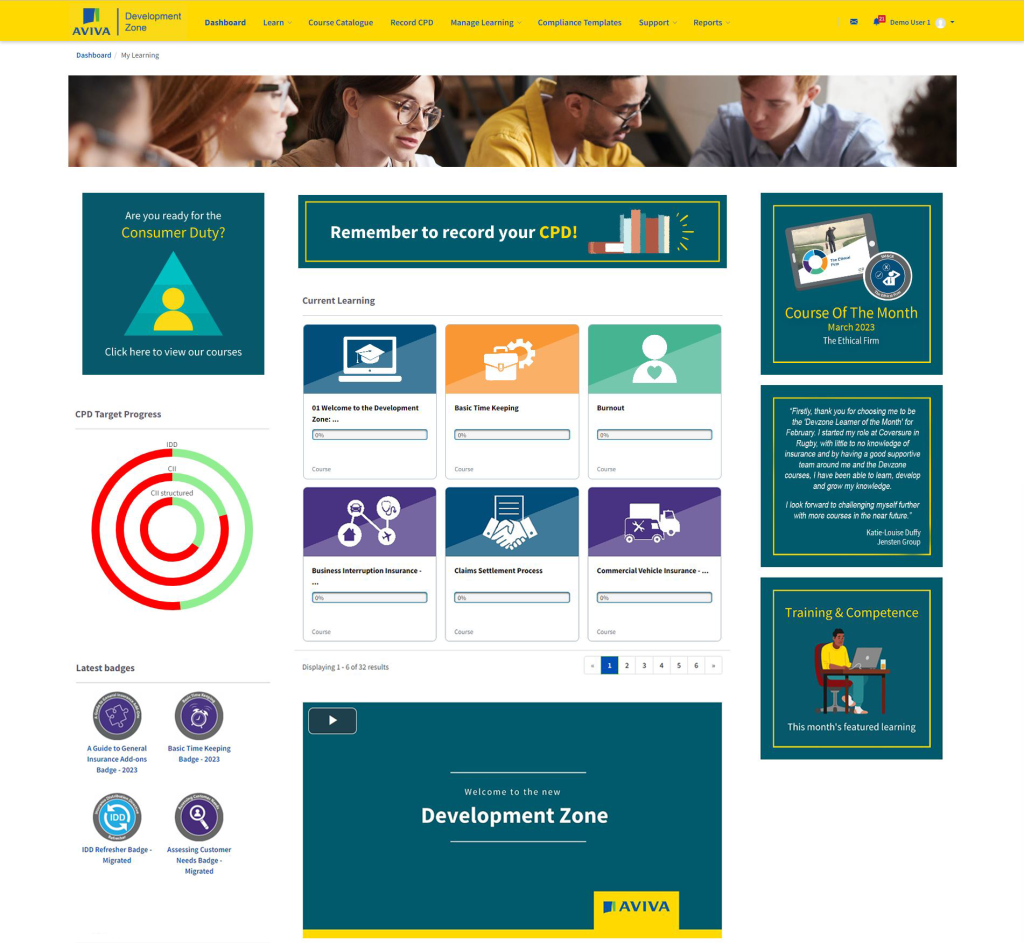

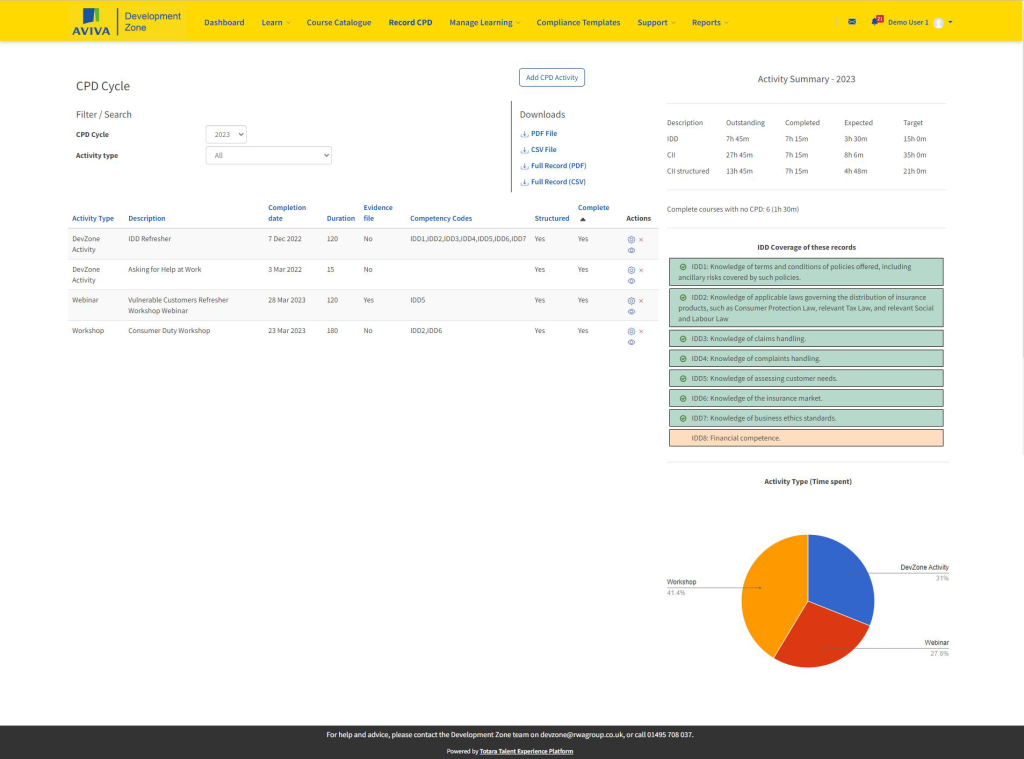

CPD Recorder – This allows RWA’s clients to create and export CPD records according to regulatory requirements. It keeps track of courses that users have completed and supports learners in completing a CPD record. The user can include information such as their development needs, a reflective statement and time taken on the activity, as well as linking these completions to the core competencies prescribed under the Insurance Distribution Directive (IDD). Appropriate charts and reports help learners and managers understand the progress they are making towards their CPD targets.

Manage Learning Dashboard – This allows for improved allocation and management of learning among large teams, including teams with multiple layers of management. This allowed for multiple courses to be assigned to entire teams, or multiple learners, using a quick and simple interface. This simplifies and improves the client experience from the original Development Zone.

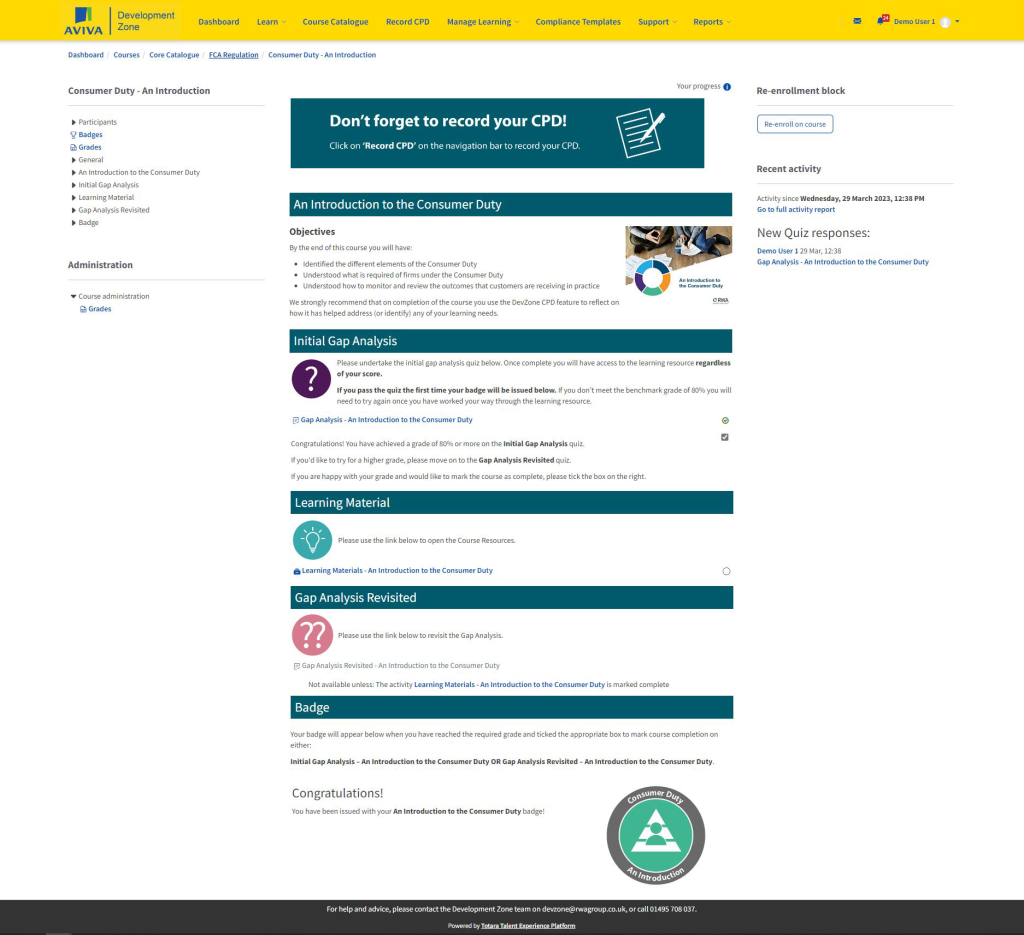

The RWA team has also embraced core Totara functionality, allowing the business to diversify its client offering. For example, course structures on the old system were rigid, but the flexibility and options in the Totara course authoring suite have allowed RWA to pilot new course formats, thereby addressing long-standing client feedback.

The ability to reskin tenancies and offer different dashboards for tenants also offers new opportunities for RWA and its clients, allowing firms to utilize their own brands and customized dashboards.

Fundamentally, this project has afforded sustainability and operational resilience for RWA and the Development Zone, providing a springboard for future growth and development for e-learning. Moreover, it allows c.16,000 insurance intermediaries an environment in which they can develop and maintain competence, whilst also fulfilling business and regulatory requirements.

“Utilizing Totara has afforded us the opportunity to maintain and enhance the Aviva Development Zone platform, providing new experiences and opportunities for our client firms, and helping us offer new flexible learning models to facilitate and encourage a positive learning and development culture in the general insurance broking sector.”

– Dr Nathan Matthews, RWA Compliance Services Ltd